Auto Enrolment

Protection

Pensions

Investments & Savings

Pension Open Market Options

Independent Advice

Wills

Lasting Power of Attorney

Tools

CIPI Background

Whatever arrangements you have made in the past, with any Company, we will track down, research and update your plans. We look to make the best quality arrangements every time. Ring on 0161 950 5329/07708 410381 to arrange an informal chat.

All Independent Advisers now work on a 'fee' basis (except for term life assurance which still pays a commission)... as explained in our Client Agreement and Service details - documents below. Advice fees can sometimes be met from the product/s arranged, meaning no additional outlay on your part.

Downloads: Client Agreement (about to be updated) and Service Proposition documents. Statement of Professional Standing Certificate. Level 4 Exam Certificate

Authorised and Regulated by the Financial Conduct Authority. FCA number 563900 This site does not use cookies

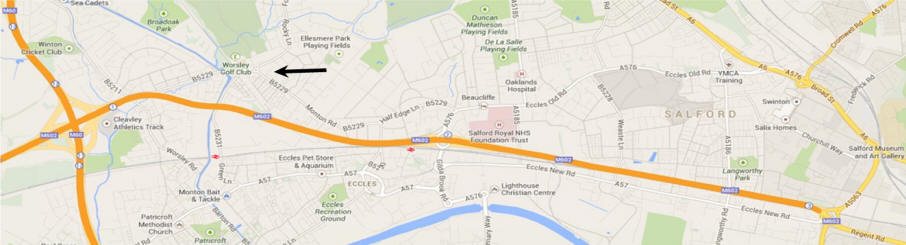

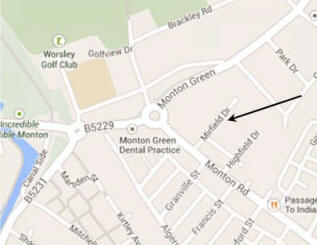

find

us...

11 Mirfield Drive, Monton, Eccles, Manchester M30 9LH Take independent advice